The VAT Reverse Charge rules for the construction sector are complex and could have a significant impact on contractors, sub-contractors, suppliers and developers.

To help businesses in the sector understand what the Reverse Charge means for them, our specialist VAT team have produced a range of resources that provide guidance on a variety of issues.

VAT Reverse Charge in the Construction Industry

From 1 March 2021, contracting businesses will need to account for a Reverse Charge in respect of services they receive from sub-contractors.

The Reverse Charge is a VAT mechanism whereby the customer accounts for the VAT due on a supply, rather than the supplier.

A business will charge itself VAT at the appropriate rate for the services supplied to it by adding the VAT to its own VAT return calculations. This VAT can then be recovered subject to the normal VAT rules (and so for many businesses the Reverse Charge will just be an accounting adjustment rather than additional VAT that needs to be paid).

The aim of the introduction of this method of accounting is to stop sub-contractors from providing services, collecting VAT, but then not paying the VAT over to HM Revenue and Customs (HMRC).

There are detailed rules in respect of the application of the Reverse Charge. HMRC set these out in their technical guide here.

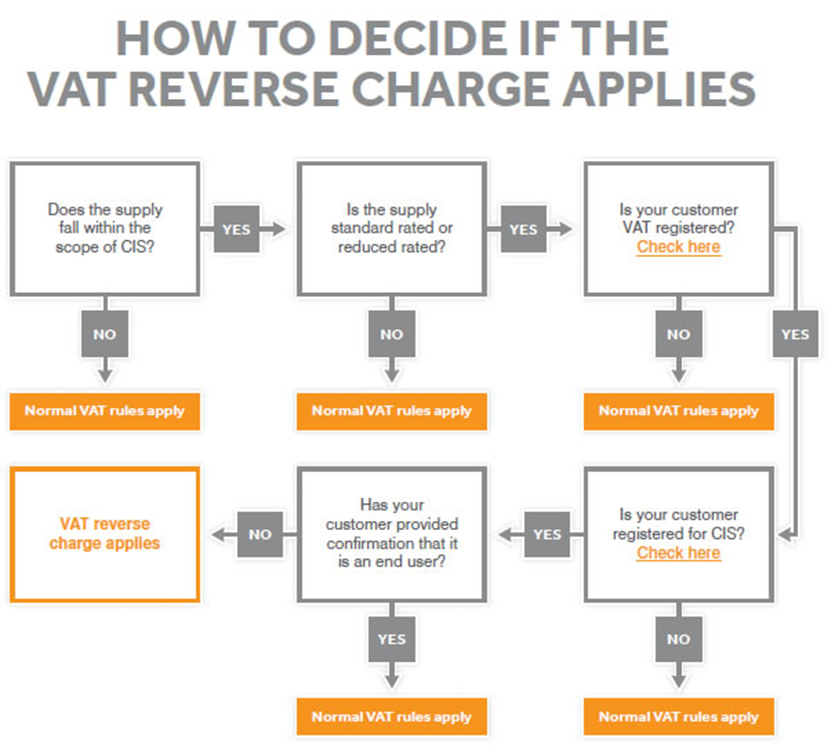

However, the diagram below gives perhaps the clearest explanation of when Construction Services will be subject to the Reverse Charge.

The rules in respect of the Reverse Charge are similar to those for the Construction Industry Scheme.

Indeed, if the services do not fall within the scope of CIS then it is unlikely that the Reverse Charge will apply.

Construction Services, therefore, include:

- Construction, alteration, repair or extension or any works forming, or to form, part of the land.

- Installation in any building or structure of systems of heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection.

- Internal cleaning of buildings and structures, as long as they are carried out in the course of their construction, alteration, repair, extension or restoration.

- Painting or decorating the internal or external surfaces of any building or structure

- Services which form an integral part or are preparatory to, or are for rendering complete the services described above

For the Reverse Charge to apply the construction services must be made to a business, which is itself resupplying those services to an end customer (see below example).

On this basis, if a business is supplying its services to an End User (i.e. a member of the public or a developer rather than a contractor) then the normal VAT rules should apply.

However, whether a customer can be viewed as an End User can be complex – particularly if the supply is to a group of companies or to a large customer such as a local authority. On this basis, a business should obtain a declaration from its customer that it is an End User.

Potential problems and how to avoid them

- Cash flow

Prior to the introduction of the Reverse Charge, VAT has been charged to a customer and paid to the supplier but, in some instances, it did not actually need to be paid by that supplier to HMRC until several months later, when the contracting business’s VAT return becomes due.

The Reverse Charge now means that the business’s customer will account for the VAT on its own VAT return and so will only pay the net value of the supply to the contractor.

Businesses in these circumstances should consider whether the loss of VAT payments to them will cause cash flow difficulties. If so, then different sources of funding may need to be considered.

- Change in accounting procedures/software

For businesses supplying Construction Services, an invoice will need to be issued.

The invoice will either need to show how much VAT is due or the rate of VAT in respect of the services. It should also contain a legend stating that the Reverse Charge is due.

The accounting system of the supplier of the services will need to be able to differentiate between those sales on which VAT will be accounted for by customers as a Reverse Charge and those sales where VAT is due in the traditional way (perhaps because the supply is to an End User).

Businesses that receive Construction Services on which the Reverse Charge is due will need to update their accounting systems, so that the VAT due is accounted for on their VAT returns.

Details of how software packages can help can be found here.

- VAT liability, staff awareness and pitfalls

The VAT treatment of building services has always been complex.

This is because, depending on the nature of the works, the supply can be either zero-rated (if this the case the Reverse Charge will not apply), subject to the lower (five per cent) rate of VAT or is standard rated (20 per cent).

Staff or business owners entering invoices onto an accounting package will need to be aware of when the Reverse Charge applies.

The construction industry can be conservative, with businesses often choosing to charge VAT when in doubt as the safest option.

However, where VAT is incorrectly charged it cannot be recovered as Input Tax.

Though HMRC may well take a soft approach to begin with, in theory, they could raise an assessment and apply penalties where VAT has been recovered on a supply to which the Reverse Charge has been applied.

It will, however, still be a ‘debt to the Crown’ allowing them to collect the VAT from the supplier. Both the suppliers and recipient of Construction Services will, therefore, need to become familiar with the new rules

If a business has any doubts about the application of the Reverse Charge further advice should be sought.

Contact our specialist VAT team on vat@milstedlangdon.co.uk if you need advice on complex VAT issues.

Meet the team: